All Activity

- Past hour

-

Credit deflation and the reflation cycle to come (part 9)

HousePriceMania replied to spunko's topic in Property Prices & Economy

Had to laugh at this one. -

Nobody does discrete style better than John.

-

Property crash, just maybe it really is different this time (Part 3)

Onsamui replied to spunko's topic in Property Prices & Economy

We might be using the horse and cart again if 'just stop oil' have their way. -

Credit deflation and the reflation cycle to come (part 9)

kibuc replied to spunko's topic in Property Prices & Economy

Newcore knocks it out of the park with its updated PEA. Using NPV5 is, naturally, a joke, but it's still the standard for some reason. I'll leave it to the mintwit experts to crunch the details, but just by comparison to its peers who use the same silly costs of money, NPV-to-capex and IRR are something to behold. https://newcoregold.com/news/newcore-gold-announces-positive-updated-2024-preliminary-economic-assessment-for-the-enchi-gold-project-ghana/ West Africa is gradually becoming my favourite region for undervalued gold juniors and explorers. -

Property crash, just maybe it really is different this time (Part 3)

spunko replied to spunko's topic in Property Prices & Economy

I live near a livery place, and know the owners. Always surprised by how un-posh a lot of the horse owners seem to be now. Most of them strike me as lower middle class rather than posh sorts. I suspect if you're truly posh you look after your own horses and employ a stable hand. Plus a lot of the horse riders sound like fishwives. Just goes to show that the stereotypes aren't always true. I miss the days of it all being posh totty -

Credit deflation and the reflation cycle to come (part 9)

Jay replied to spunko's topic in Property Prices & Economy

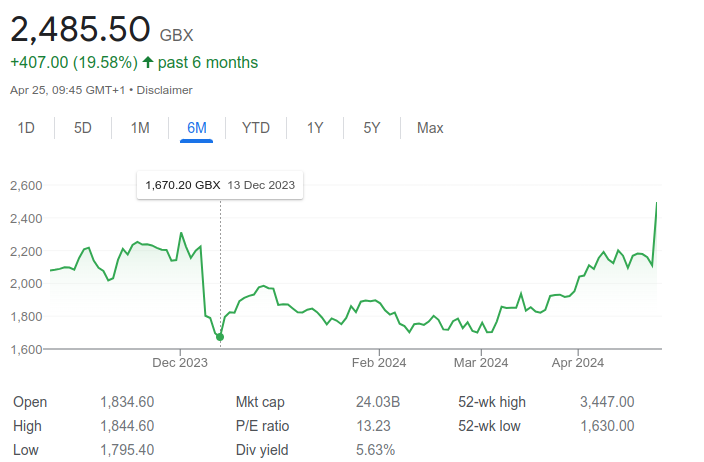

Me..only a small holding..think it’s an all share deal..undervaluation of aal.. adds a bit of fizz but still way below what it has been.. -

Credit deflation and the reflation cycle to come (part 9)

SpectrumFX replied to spunko's topic in Property Prices & Economy

The recent changes to the university pension scheme provide a potential model to follow. They put a cap on the DB element, and put all of the contributions over that cap into a parallel DC pot. One of the benefits of that approach is that you can drag your feet on inflating the DB cap to progressively switch a larger percentage of the pension over to DC. The irony of all of this is that the vast majority of public sector workers have no idea of the value of their pension, and would gladly give benefits up for a little bit more money now. -

Credit deflation and the reflation cycle to come (part 9)

Chewing Grass replied to spunko's topic in Property Prices & Economy

Just sack State Employees for using the wrong pronouns, no need for redundancy payments. - Today

-

Credit deflation and the reflation cycle to come (part 9)

reformed nice guy replied to spunko's topic in Property Prices & Economy

True. It's a massive unfunded liability anyway that is structured as a pyramid scheme. You need both a persistently increasing public sector and money printing. It's just of balance - if you slow down public sector growth your increasing the need for immediate money printing and vice versa. We are screwed either way -

Credit deflation and the reflation cycle to come (part 9)

Democorruptcy replied to spunko's topic in Property Prices & Economy

Might need to print a few quid for all those lumpy lump sums. -

Credit deflation and the reflation cycle to come (part 9)

reformed nice guy replied to spunko's topic in Property Prices & Economy

A much fairer and easier way to stimulate investment would be to convert all the existing DB pensions to DC. Give all of the public sector workers a lump sum in NEST and allow them to transfer if they like. That way there would be more money floating around for equity investment -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

HL dont even offer Australia or Hong Kong.Of course they want to funnel people into funds because they make much more,but they are missing a trick and getting ridiculous.I suspect we will see a merger in the sector at some point so they can open up more markets though.I think L&G or M&G would be looking over HL and ABRDN for instace.ABRDN and M&G would be a superb fit. -

Credit deflation and the reflation cycle to come (part 9)

kibuc replied to spunko's topic in Property Prices & Economy

For now, they struggle to grant proper access even to markets that they seemingly have on offer. Just last week I learned the hard way that Impact and Defiance both became "sell only" on II and won't be available for bid anymore. And I moved to II from HL last year mostly because pickings were even slimmer there - 1 in 3 names I was interested in at most. -

Credit deflation and the reflation cycle to come (part 9)

Democorruptcy replied to spunko's topic in Property Prices & Economy

AAL, in Feb one of the analyst firms was tipping it as a takeover target and I think the suggested price was similar to today. -

Credit deflation and the reflation cycle to come (part 9)

nirvana replied to spunko's topic in Property Prices & Economy

another interesting example of why you BTFD and take notice OF 'higher lows'........go on, who is it? edit: bit of a giveaway, mentioned above lol -

Credit deflation and the reflation cycle to come (part 9)

Democorruptcy replied to spunko's topic in Property Prices & Economy

Our lot seem to be sending mixed messages about that. Last Autumn Hunt was trying to get Indian firms to list directly in London, then the March budget wanted more investment in UK firms, British ISA etc. At the moment UK asset managers have a captive audience via funds. Our asset managers share prices are down but their foreign funds have done OK such as Abrdog's New India +34% and Jupidog's India +76% since Autumn 2022. -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

I picked it up early,but missed how extreme it would be.I expected other investors to see the value gap.However i think the gap is so big its bringing in full out bids rather than on market.Due to interest rates the bids are share bids,but what these bids really say is here is a way to get out of the UK market.The destruction of the tax base due to the socialist policies is huge.The list of destructive policies is endless. -

Now Pix is so popular in Brazil, they are starting to head down the selective tax route. "It also introduces a selective tax targeting products considered harmful to the environment and health." https://www.reuters.com/world/americas/brazils-government-submits-rules-streamline-consumption-taxes-2024-04-24/

-

Cheaper ground rents like yours will eventually be phased out, once they introduce a "cap".

-

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Aka "Crowding Out". Bad money (excessive revenue gilts) crowding out good money (productive investing). -

Credit deflation and the reflation cycle to come (part 9)

Pip321 replied to spunko's topic in Property Prices & Economy

Global warming crisis, emergency powers etc…. Listening to this and whether (weather😉) or not these powers are enacted it makes me realise just how climate change agenda is false. I am happy to take as read, there is some truth in climate change but the governments I see do not have our best interests at heart….at all. Ie war, sanctions, monetary printing, spending money on shite instead of things we need, migration etc tv So knowing that what governments focus on is not for our benefit….it does beg the question, why the huge focus on virtue signalling and climate change. It’s not for the greater good….I know that Likely to ensure less reliance on Russia/ Middle East (because energy is power) and also a handy agenda they might use for control, power and for them to profit from it in the short term. -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

If the Anglo deal went through there is a good chance Sibanye merges with the platinum business,they own lots of the connecting mines and assets so would be the only likely ones who could cut costs with a merger.HMY pretty much consolidated the SA gold mining sector,Sibanye might do the same for PGMs. -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

Copper and Potash.BHP have a huge a prospect for Potash in Canada,i suspect they want to expand and enter that.For the UK market the fact now big caps are being bid for means we have crossed the Rubicon.Again,we are losing all our tax producing,dividend producing companies thanks to bennies.People laugh at that,but its the exact reason.Polos cannot tax enough for bennies,4% structural deficit,so they force pension schemes into gilts so they can montetise them (financial repression) that money would of gone into UK equity,instead it goes into fat Shaz's ample belly.The UK market is likely undervalued by 50% or more if we include the ones forced down be idiot regulators.When Brown opened the bennie floodgates (at first paid for by destroying pensions by removing the dividend tax relief) he destroyed the UK economy. The big platoforms like HL and II need to get their fingers out though and allow access to far more markets than they do now.UK investors need as many ways to diversify out of the UK as they can. -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

While I posted that, I had no clue about the whole story. Amazing. Our governments have been at this for a while. The parallels (covid ppe dumps, lockdown, fake media, etc to "make it real",....)! So this time round just change the name, the rest no doubt will stay the same! -

Credit deflation and the reflation cycle to come (part 9)

SpectrumFX replied to spunko's topic in Property Prices & Economy

I think that's the third time that they've announced those civil service cuts to prepandemic staffing levels. Arguing that it's a saving that will allow expenditure elsewhere is risable. That spending was uncontrolled growth that was all on the tick in the first place.