All Activity

- Past hour

-

Credit deflation and the reflation cycle to come (part 9)

MrXxxx replied to spunko's topic in Property Prices & Economy

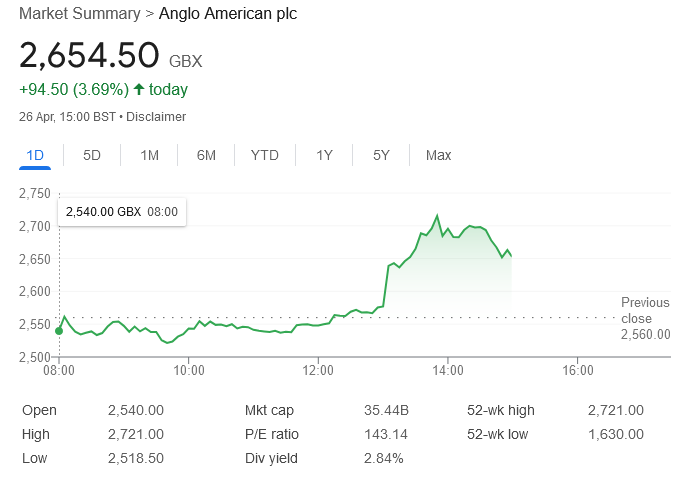

Here you go, FYI the BHP deal equated to ~2510 yet a day after AAL rejecting BHP's offer [pi$$take] The Market thinks it should be at least 2721, so about £2 more: -

Credit deflation and the reflation cycle to come (part 9)

Axeman123 replied to spunko's topic in Property Prices & Economy

Not totally relevant, but you would have to have a heart of stone not to laugh at this from the based Telegraph: https://archive.ph/SaVIQ Ireland is paying the price for its Brexit arrogance The open border Dublin insisted on is now allowing asylum seekers to pour into the country -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

I'm working on all that atm but have a chance as no kids to look after and a lowish cost lifestyle in a newish sort of retirement (at least from PAYE). I went through the various allowances here a while back and you've listed some of them. I was reviewing asset allocation modelling for investing this week and then realised I really needed to structure things to maximise these allowances where reasonable (i.e. not at the expense of sound investment returns) and for the asset allocation optimisation to mostly follow. But again, not letting the tax tail wag the investing returns dog. An example is the starting rate for savings. £5k tax free pa in certain investments which includes gilts and corporate bonds (either individually or in a fund meeting the 60% rule). That's £100k at 5%. Ignoring other concerns, I could hold up to that outside a SIPP than in a SIPP, if the asset allocation model said to hold them for diversification (and/or to contribute towards "needs" in a required low vol (held to maturity) way). Could use the 25% tax free towards that and then take out £12,570 (personal allowance) pa asap before state pension age as well. Just an example. Not fully validated and depends on available funds and the order of preference in options (e.g. atm ISA contribs would be #1 for me). -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Ta. I thought WHT was higher for UK residents but apparently 15% (so still worth it for a number of companies): The above is from the HMRC forum which can be quite useful at times for UK taxpayers. Of course the tax credit is not available for shares held in a tax wrapped account. I may be wrong but I seem to remember no WHT on companies like Yancoal Australia as they were foreign (e.g. HK) domiciled. I'm mainly a fund guy now, with more sociable hours! -

Credit deflation and the reflation cycle to come (part 9)

AWW replied to spunko's topic in Property Prices & Economy

This is easier said than done for those with a family to support. I dump everything they allow me to into my SIPP, I open a new ISA and LISA every year, I put rainy day cash into low coupon Gilts, I buy CGT free coins, yet they still do me for tens of thousands in income tax each year and how much more in VAT and myriad stealth taxes, because I have to take enough income to support my family. Keeping it below the personal allowance, even the 40% bracket which I used to be able to do, is impossible with current inflation and frozen thresholds. - Today

-

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

-

Credit deflation and the reflation cycle to come (part 9)

WICAO replied to spunko's topic in Property Prices & Economy

Not an expert but what I currently understand - DYOR - etc... Generally, as I now understand it as a resident dividends of Australian shares outside of Superannuation are fully taxed effectively at the same rates as earnings. No ISAs or equivalent. But, a credit is given for the tax the company has already paid on its earnings which makes a big difference. They call them Franking or Imputation Credits. I understand that Labour partly lost an election over them so they seem pretty safe for now... As a resident I don't pay any withholding tax on Australian shares. I'd guess if you were a resident without a Tax File Number you would but I can't see how you could live here as a resident without a TFN. -

Credit deflation and the reflation cycle to come (part 9)

Axeman123 replied to spunko's topic in Property Prices & Economy

Arguably it is just continuing what team Biden is doing by less obvious methods, mostly involving the % of short dated bills issued by the Treasury under Yellen (AIUI). Financial conditions are much looser than Powell wants them already. -

Property crash, just maybe it really is different this time (Part 3)

Wight Flight replied to spunko's topic in Property Prices & Economy

I do so like averages. BIL is in Elmbridge. His mortgage is only a few £k so might go up by £10. So someone else is getting hit with an extra £900 per month to create that average. (And why don't they specify what average they used. It is somewhat important). -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Do you residents get to mitigate the Aussie WHT? A bit off-putting for me when I was div investing. -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Saw it on the turn a few weeks back but didn't react as focussed on GDGB and the other ETFs instead. Would have been a nice add though and a nicer chart to follow than say GDGB. Maybe the end of the pullback as technically it was a strong move yesterday. Hopefully a pull back to fill yesterday's gap in price for a better entry should we choose to dabble in stocks rather than ETFs (which also strengthened). Did no harm buying the day or so before ex-div for a change! -

Credit deflation and the reflation cycle to come (part 9)

Democorruptcy replied to spunko's topic in Property Prices & Economy

Sounds like Trump wants to try an Erdogan style approach to central banking: -

Credit deflation and the reflation cycle to come (part 9)

WICAO replied to spunko's topic in Property Prices & Economy

Definitely still investing globally and still have plenty of wealth outside of Australia. That part of my strategy is unchanged but I am now treating Australia as my home market now. Just manoeuvring myself as we expect we'll be here a long time and want to be tax efficient and low expense. ISAs are not tax efficient here at all. To the average person on the street tax efficiency seems to come from main residence, Australian shares and Superannuation (a bit like a UK private pension). Equivalent of State Pension is also means tested but they effectively ignore a large portion of your main residence in that assessment. -

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

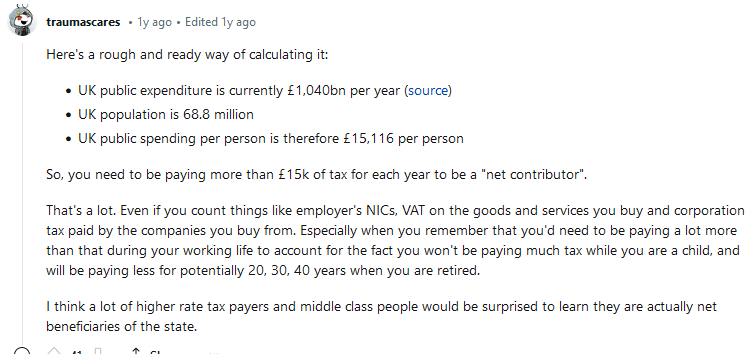

Short answer. No. But there was a post on Twitter (I know) where someone broke it down for the average family and did the maths. Included kids' education, healthcare, road maintenance (lol), the lot. Looked pretty plausible tbh. Quick google found this: https://www.reddit.com/r/UKPersonalFinance/comments/12oh51a/is_there_a_calculator_where_you_can_see_whether/ -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

I always new the control they had over the media ,but i was always in the same boat as you regarding how they could do it to the extent that was claimed I think the below is just a small section of a larger warren -

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

David Icke goes on about this. He calls it the bloodline. -

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

The problem with that is what happens when you hit £200,000? Which shares move from the protection of the tax shelter? How is that decided? What happens if it drops back below? Can you re-buy them? Minefield. Easier to just abolish the ISA completely. Tell me that in 20 years! -

Credit deflation and the reflation cycle to come (part 9)

Axeman123 replied to spunko's topic in Property Prices & Economy

Have you considered Singapore for some of it? I wouldn't feel at all safe with everything in Oz. Totalitarian govt keen to enforce collectivist solutions faces its first recession in decades Dependence on China means they could get sanctioned to fuck by the yanks -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

I did,i retired at 48.I had a 6 year retirement from 29 to 35 as well where i pretty much shagged my way around England and Scotland using the new dating apps,i tried to do birds in every county,but missed a few,i was like a machine,crackers really but i could write several books on those years and the situations i got myself in.Got sick of listening to Dido as i nailed them all though . I doubt il ever work again,my job now is to fight this war for my family against the enemy.I guess humans have gone through this many many times,nothing new under the sun after all. -

Credit deflation and the reflation cycle to come (part 9)

WICAO replied to spunko's topic in Property Prices & Economy

I very much spread my risk as far as is practicable and take practical precautions but I'm not going full on "tin full hat". My choice and if the world ends I'll look pretty silly but I'm not sure I want to live through an TEOTWAWKI scenario anyway to be honest. A black swan less worse than that and to me it seems Australia is far better positioned than the UK. The country has far less debt and a lot more natural resources to name but two. -

Credit deflation and the reflation cycle to come (part 9)

Formerly replied to spunko's topic in Property Prices & Economy

Do you have a source for that. I'd imagine a lot earning >£50k contribute to pensions to bring them below that threshold. I'm one though the threshold for me is £43k (Scotland). My salary is above 52k - am I still a net tax payer? My point is that 9% paying for every thing is probably optimistic. It's probably far less than 9%. -

Credit deflation and the reflation cycle to come (part 9)

wherebee replied to spunko's topic in Property Prices & Economy

-

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

Funny enough i nearly did near the bottom,but didnt.Bad mistake. -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

Did you ever see the video interview of some Israeli government figure from back around 2018 where he talked about how four regions of the Ukraine could be the answer to Israel's problems of a greater Israel in the middle east ,i.e they would/could be Greater Israel ,Donetsk, Kherson, Luhansk, Odesa Edit ,i`m under the bed if anyone wants me this was at the top of my feed -

Credit deflation and the reflation cycle to come (part 9)

HousePriceMania replied to spunko's topic in Property Prices & Economy

Spiders that'll kill you Spiders bigger than your hand Croco-fucking-diles Snakes that will bit your knob of Same western spiv bankers and their debt bubble Same unelected head of state Women who act like bloks The fucking rain, never fucking stops raining in Oz. Seriously though, it's the same set of globalist WEF bankers shills in charge all over the western world, I dont see moving to somewhere like that will protect you ultimately, they'll still send you or your kids out to die for king and country. Sure, the weather is better and it's got a lot of beaches, but so's Spain and you'd be able to give someone 1000 Euros to not find you when the draft board come a knocking.