All Activity

- Past hour

-

Credit deflation and the reflation cycle to come (part 9)

Castlevania replied to spunko's topic in Property Prices & Economy

It was more than that. Think it was around $2.80 paid out in 2023 per ADR. As I said, when the going’s good they churn out dividends (or as @Mandalorianwould say return your capital back to you). -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

Good point,fine for a SIPP luckily.Be interesting to see what the divi is within a SIPP as it looks like the last year might of been 14%.Looking at them they look like you should buy now,hold until they hit they $18 level and sell.Iv made good money over the years in several Brazilian stocks doing similar,some of them over and over,never multi bagging,but always consistent 50%+ gains.Tends to be some political issue when they all get hit and out of favour.Most institutions avoid the area because being mostly cyclical markets they cannot stomach the risks,but very lucrative for retail who understand the cycles at work. -

We already do have a kind of rent control. Just it is hardly ever used. https://www.gov.uk/private-renting/rent-increases

-

Labour are on the radio saying they wont introduce rent controls. Dont trust that at all so its obviously on the agenda. We dont often put up the rent on our flats unless a tenant changes. Weve decided to do a big hike now taking into account what market value would have been in 2 years. I imagine others are thinking the same this morning.

- Today

-

Credit deflation and the reflation cycle to come (part 9)

Inigo replied to spunko's topic in Property Prices & Economy

I suspect the problem lies mostly with American suppliers, so far. Am American based sub-supplier are now asking for end user details for some specialised kit (we just tell them to sod off and that they are for stock). We have been asked not to quote for a particular weapons manufacturer as there was a possibility that the end user might be a country that America didn't like and the ceo of the manufacturer was nervous about being prosecuted in the states. -

Credit deflation and the reflation cycle to come (part 9)

Errol replied to spunko's topic in Property Prices & Economy

Are they paying money? Is it legal business? If so, what's the issue? -

Credit deflation and the reflation cycle to come (part 9)

Castlevania replied to spunko's topic in Property Prices & Economy

One thing to note is because their primary listing is in Colombia you can’t hold them in an ISA. -

Credit deflation and the reflation cycle to come (part 9)

Inigo replied to spunko's topic in Property Prices & Economy

I've been asked to quote some equipment by a tobacco company (have to be coy due to an NDA) and the first question they asked was if we were prepared to do business with them. It seems as though some suppliers are refusing to engage with tobacco companies due to the whole ESG thing. -

Credit deflation and the reflation cycle to come (part 9)

Castlevania replied to spunko's topic in Property Prices & Economy

PetroTal is one that I haven’t bought but have considered a small punt. Canadian company (with a primary listing in Toronto and a secondary AIM listing) operating in Peru. Market cap is only around £500m. Reasonable (over 10%) dividend yield over the past year (but half that of Petrobras and Ecopetrol and they don’t have the production diversity of the other two). -

Credit deflation and the reflation cycle to come (part 9)

M S E Refugee replied to spunko's topic in Property Prices & Economy

Once they run properly I will be converting most of the profits into 1oz Gold Britannia's. -

Credit deflation and the reflation cycle to come (part 9)

wherebee replied to spunko's topic in Property Prices & Economy

many of the smaller miners haven't even begun to move yet. I have 4 small aussie miners, ranging from holes in the ground with liars on top to confirmed and licensed digs about to start producing - and all have blipped only 1-2% this week. One is 25% up already from start of year, others flat from purchase. My expectation is when they run, they will run very hard and that's when I will sell at 100%+ up. -

Credit deflation and the reflation cycle to come (part 9)

Lightscribe replied to spunko's topic in Property Prices & Economy

Endeavour killing it for me this week. -

Credit deflation and the reflation cycle to come (part 9)

sancho panza replied to spunko's topic in Property Prices & Economy

https://mishtalk.com/economics/is-china-dumping-us-treasuries-and-buying-gold-bloomberg-says-yes-pettis-uncertain/ Is China Dumping US Treasuries and Buying Gold? Bloomberg Says Yes, Pettis Uncertain Beijing offloaded a total of $53.3 billion of Treasuries and agency bonds combined in the first quarter, according to calculations based on the latest data from the US Department of the Treasury. Belgium, often seen as a custodian of China’s holdings, disposed of $22 billion of Treasuries during the period. -

The UK's Q4 2023 banking crisis.

sancho panza replied to sancho panza's topic in Property Prices & Economy

https://wolfstreet.com/2024/05/16/who-fell-behind-on-their-credit-cards-delinquencies-balances-burden-available-credit-and-the-maxed-out/ -

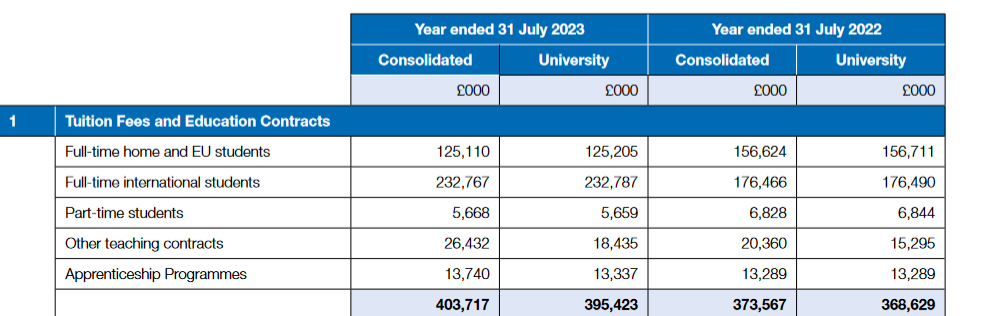

Universities going bankrupt (either morally or financially) thread

sancho panza replied to sancho panza's topic in Property Prices & Economy

going through the cov intersting points 1) withdrwan from USS 2) 20% drop in UK/EU stdents, 32% rise in foreigns in tax year 21-22 https://www.coventry.ac.uk/globalassets/media/global/09-about-us/key-information/financial-reports/coventry_university_group_annual_report_2022-23_signed.pdf page 46-My comments-confirms withdarwal from USS The deficit for the year has fallen from £32.9m in 2021/22 to £2.4m in 2022/23. However the prior year deficit was largely driven by the one off settlement of pension liabilities of £35.9m, following the withdrawal from the USS pension scheme, without which, a surplus would have been delivered last year. Full time UK and EU student fee income has reduced by 20.1% to £125.1m (2021/22: £156.6m). Full-time international student fee income has risen by 31.9% to £232.8m (2021/22: £176.5m). The University continues the growthin this important activity, despite the increasingly challenging markets we operate in. Page 56-MC,big balance sheet but how much of that is CRE in the centre of cov that noone lese would want? page 60-MC,problems becoming clear,some big cuts coming,also big detbs in the shape of £95mn loan coming due The latest forecast position at the date of signing, arising from the lower than expected intake in Autumn 2023 along with anticipated intakes in January and May 2024 being below budgeted expectations, is that income for the year to 31 July 2024 will be c£85m adverse to budget. As a result of this reduction in income and the expected deficit this creates, it has been identified that around £40m of savings will be required in the year to 31 July 2024. This level of savings will ensure that the EBITDA to net interest requirement is met with sufficient headroom and also ensure that cash balances remain at a sufficient level to meet minimum liquidity requirements. In order to meet these requirements for the entire forecast period to 31 July 2025, additional savings of £55m will be required in 2024/25. Sale of non-teaching buildings is already being considered as part of future estates strategy, and so consideration has been given to bringing forward plans that are already in train to sell University owned buildings. This would provide sufficient cash to repay the Private placement debt of £95m that gives rise to the covenant requirement in respect of EBITDA to net interest, Page 65-MC- Cov clearly been recruting internationally.They got nearly more students than people live in cov and remembre accomodation at 70% occupancy Page 67-MC_ itneresitng tosee cov is chucking £50mn at state pension and pulbic sector pension pager 70-MC-heres where the agents costs bget buried page 76-MC-interesitng to ntoe theyre reducing the valeu fo their CRE already Obligations under finance leases are secured against the Godiva student accommodation. At 31 July 2023 this had a net book value of £56.3m (2021/22 - £58.2m). - Yesterday

-

Credit deflation and the reflation cycle to come (part 9)

PETR4 replied to spunko's topic in Property Prices & Economy

Global X MSCI China Consumer Discretionary ETF https://www.google.com/finance/quote/CHIQ:NYSEARCA?window=5Y -

Universities going bankrupt (either morally or financially) thread

sancho panza replied to sancho panza's topic in Property Prices & Economy

thats super work there gaz.simple maths really does get the situtiona bout right imho. like you say there's a lot of otehr costs. looking at cov uni which i will focus on next week,their revenue is £480mn,so £54mn going in agents fees is big;ly moolah. and from yor figures if they cant make a profit charigng poor bastards £9k for 6/8 lectures a week in history being taught by a psot grad ,then they defintiely shuldnt be teaching people buisness studies jut checking covs annuals and it backs up tyou point gaz https://www.coventry.ac.uk/the-university/financial-information/finance/ from wiki cov is using 10% of its income on agents fees.first year that doesnt pay a return could get interesting -

Good luck and hope it goes through smoothly and quickly for you!

-

Credit deflation and the reflation cycle to come (part 9)

sancho panza replied to spunko's topic in Property Prices & Economy

interesitng that there have been periods where china shanghai premium has dissappered DB also @Castlevania @Cattle Prod any other obscure lat am oilies that one might 'spray n pray' -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

Ecopetrol seems to own telcos in Argentina and other Latam countries as well.Largest company in Colombia.and the biggest energy transmission company in Latam ,yet only $24 bill market cap.Think il join you in them next week. For everyone else, https://www.ecopetrol.com.co/wps/wcm/connect/625e6827-ce65-4b4f-bf19-de070d9fbdb7/Ecopetrol_Investor+Presentation_Jan+2024.pdf?MOD=AJPERES&CVID=oPMyzu1 -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

Bad idea,because if @Yellow_Reduced_Sticker goes ,so do i.This thread is about amazing calls mixed with banter. -

Credit deflation and the reflation cycle to come (part 9)

sancho panza replied to spunko's topic in Property Prices & Economy

Yeah we ended upmwith a 6% harbur postion but it's with profits and circa 295 after they kitchen sinked the results in 2023,weve had three divis as well..I wouldnt normallytake a biig postion in a smallish producer like ahrbour but it was one where i was 'in for free' with profits and I like to run some risks.if it loses thats life imho but I really liekd what they did with their 23 results.and the wintersall deal was super as well. Im interested in those latin american oilies.never heard of ecopetrel.are there any others ? Im about to sell some total aroudn 67E and buy some woodside with the proceeds hattip @wherebee. bit of geogrpahcial diversity does you no harm imho. I've sold some of the shell and BP we roled into but were' stil 30% oilies by booked cost inlc a 10% postion in shell at £13 smackers. which we may not sell for some years. -

Credit deflation and the reflation cycle to come (part 9)

Cattle Prod replied to spunko's topic in Property Prices & Economy

Yes they have less political risk than the UK. Don’t believe me? Ask Chevron. Or observe their actions, I should say. The fact that most investors don’t understand that means there is a mispricing. Good strategy. -

Credit deflation and the reflation cycle to come (part 9)

onlyme replied to spunko's topic in Property Prices & Economy

Had a very quiet spell late last year to early spring, been busy since. However there has been a very consistent theme with nearly all the work - doing up places, fixing stuff primarily to present them to sell. -

Credit deflation and the reflation cycle to come (part 9)

Cattle Prod replied to spunko's topic in Property Prices & Economy

The VAT thing makes sense, it’s too consistent. There is still a spread on the gold, £43 an oz currently. I wonder is 2% enough of an arb to cover transport and insurance, maybe if you’re buying 100 tons of it. Then you’re looking at $135 million. Physical does seem to be flowing east.