All Activity

- Past hour

-

Credit deflation and the reflation cycle to come (part 9)

Yellow_Reduced_Sticker replied to spunko's topic in Property Prices & Economy

interesting... Turkey always reminds me of one of my all time favorite films, Midnight Express ...for those that don't know ...in 1978 Billy Hayes, an American college student, is caught smuggling drugs out of Turkey and thrown into prison.(based on a TRUE STORY) If you lot haven't seen it, watch it here for FREE! The book is even BETTER! -

Credit deflation and the reflation cycle to come (part 9)

Red Debt Redemption replied to spunko's topic in Property Prices & Economy

Well ain't that handy unsustainable pension crisis solved brah! - Today

-

Credit deflation and the reflation cycle to come (part 9)

sleepwello'nights replied to spunko's topic in Property Prices & Economy

Exactly. Debt jubilees had the same effect. It made the lender far more careful in assessing the credit worthiness of the borrower. -

Credit deflation and the reflation cycle to come (part 9)

Errol replied to spunko's topic in Property Prices & Economy

Such drivel. Is this the best they can manage? It's just pathetic. They make me sick. -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

38% of universal credit claimants are working ,almost all of those on working tax credits have now been transferred to UC -

Credit deflation and the reflation cycle to come (part 9)

Plan-b replied to spunko's topic in Property Prices & Economy

The most terrifying words in the world... "I'm from the Government and I am here to help" -

Credit deflation and the reflation cycle to come (part 9)

leonardratso replied to spunko's topic in Property Prices & Economy

Key features of the 212 Cash ISA 5.2% interest (variable), paid daily Withdraw anytime No account fees Start with just £1, no minimums £85,000 FSCS protection Transfer your ISAs for free You can transfer your ISAs in and out, paperless and free. flexible isa as well apparently, making the s&s isa flexible as well, doesnt say when though. ah it does actually; The changes will take effect on 08.06.2024. If you have any questions, contact us at [email protected] -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

-

Credit deflation and the reflation cycle to come (part 9)

Plan-b replied to spunko's topic in Property Prices & Economy

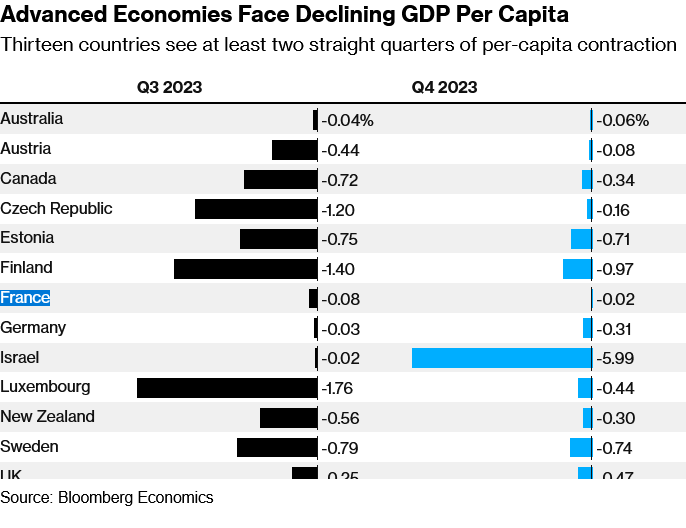

Interesting thanks SP. 'GDP' is used a lot in that article the problem is it's a false concept, the situation is far worse than the article sees it. GDP as a measure is totally pointless, Dr Tim has it sussed. He's been talking sense for more than ten years I've been reading his blog, I introduced his site here several years ago IMO he needs more coverage. 'Over that same period, global real GDP expanded by $45tn, or 74%. This means that each dollar of reported growth between 2002 and 2023 was accompanied by $3.20 of net new debt, or by about $8 of net new broad financial assets. If it takes somewhere between $3 and $8 of new debt or quasi-debt to generate a dollar of GDP growth, paying off debt incurred in the present from growth generated in the future is a mathematical impossibility. An example here is the United States which, during 2023, generated reported real growth of $675bn on the back of a $2.4tn fiscal deficit.' https://surplusenergyeconomics.wordpress.com/2024/05/07/277-at-the-limits-of-monetary-possibility/#comments -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

-

Credit deflation and the reflation cycle to come (part 9)

Chewing Grass replied to spunko's topic in Property Prices & Economy

It is easy to have an economy when you are constructing stuff(both private and public) with printed and borrowed money. This was the US Economy from WW1 once the Gold Rush was done and dusted. Once you have a 'built world' around you its over and the importation of millions of useless feckers just accelerates the demise. -

Credit deflation and the reflation cycle to come (part 9)

Yadda yadda yadda replied to spunko's topic in Property Prices & Economy

Full employment is a malleable statistic. It must never be achieved or else workers would have pricing power. -

Credit deflation and the reflation cycle to come (part 9)

Yadda yadda yadda replied to spunko's topic in Property Prices & Economy

It is worse than that. Imputed rent has risen because of an increased population. The existing housing stock is generating more GDP because we're trying to cram more people into it. This demonstrates how stupid GDP is as a measure of economic wellbeing. A better measure would be disposable income per capita. No doubt that is falling more rapidly than GDP per capita. Although the latter is likely worse than reported if you doubt the inflation statistics, as I do. -

Credit deflation and the reflation cycle to come (part 9)

Lightscribe replied to spunko's topic in Property Prices & Economy

Because of magical 16hr bennie jobs. Our economy revolves around made up part time and grifter gig workers to meet the tax credit threshold so it makes it look like we have a lot more employment on paper than we do. Clever eh? Shhh just keep it under your hat though 🤫 it’s a good thing for our other main part of the economy, house prices. By carving up respectable houses, renting them out as HMO shitboxes and fleecing the younger generation it’s great for the figures. Meh who needs outdated things like productivity? Just don’t draw attention to the giant elephant in the room ok, as it’s a good gig we’ve got going on as you’ll spoil it for all of the boomers and MPs. -

Credit deflation and the reflation cycle to come (part 9)

MrXxxx replied to spunko's topic in Property Prices & Economy

WG. had an offer: https://www.theguardian.com/business/article/2024/may/08/oil-services-company-john-wood-group-rejects-14bn-takeover-offer ...but the other party were 'muppets', offering 35p less than an offer WG. rebuffed last year; things have improved since then i.e. oil prices, and last years offer was from a Private Equity firm...so if they think the assets [to be stripped?] were worth an offer of 240p why would WG. accept todays offer of 205p?!...this QUOTE made me smile: “The board carefully considered the proposal, together with its financial advisers, and concluded that it fundamentally undervalued Wood and its future prospects,” it said. Basically then told them to £uck off, and not to try and 'take the pi$$'! :-))) -

UK Govt Coronavirus Response: Sceptics Thread

One percent replied to sancho panza's topic in Property Prices & Economy

That’s because he is. A war criminal at the very least. -

UK Govt Coronavirus Response: Sceptics Thread

Mouse replied to sancho panza's topic in Property Prices & Economy

He looks so evil there! -

UK Govt Coronavirus Response: Sceptics Thread

leonardratso replied to sancho panza's topic in Property Prices & Economy

I wonder how long tony blair would last if just released on any random street anywhere in the world with no security. -

UK Govt Coronavirus Response: Sceptics Thread

Chewing Grass replied to sancho panza's topic in Property Prices & Economy

Is that Quentin Wilson, William Hartnell or Tony Blair - its hard to tell. -

UK Govt Coronavirus Response: Sceptics Thread

leonardratso replied to sancho panza's topic in Property Prices & Economy

-

Credit deflation and the reflation cycle to come (part 9)

Funn3r replied to spunko's topic in Property Prices & Economy

How can Britain be "close to full employment" when we know there are millions of bennies people and Fake Sickers? -

UK Govt Coronavirus Response: Sceptics Thread

Mouse replied to sancho panza's topic in Property Prices & Economy

I'm glad to be an idiot then! I bet he didn't take it. -

UK Govt Coronavirus Response: Sceptics Thread

sancho panza replied to sancho panza's topic in Property Prices & Economy

tony bliar unless you're vaxxed you're an idiot what a c###..! -

Credit deflation and the reflation cycle to come (part 9)

sancho panza replied to spunko's topic in Property Prices & Economy

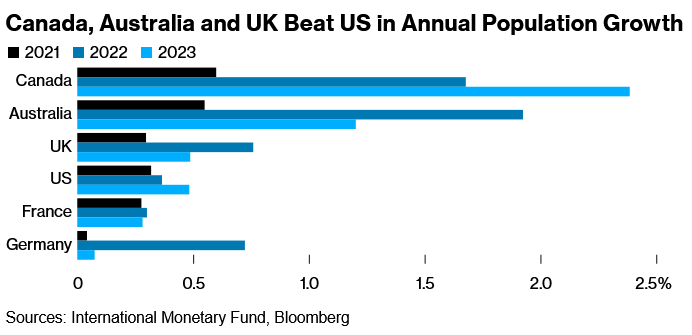

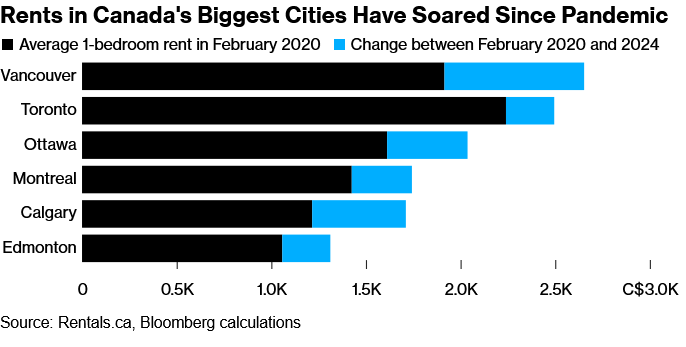

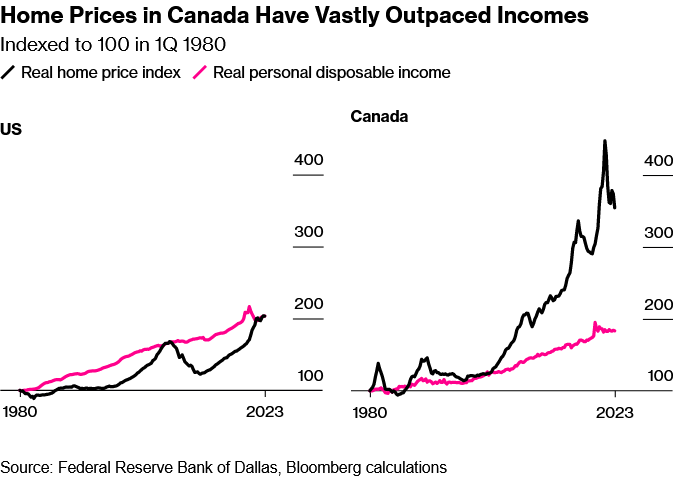

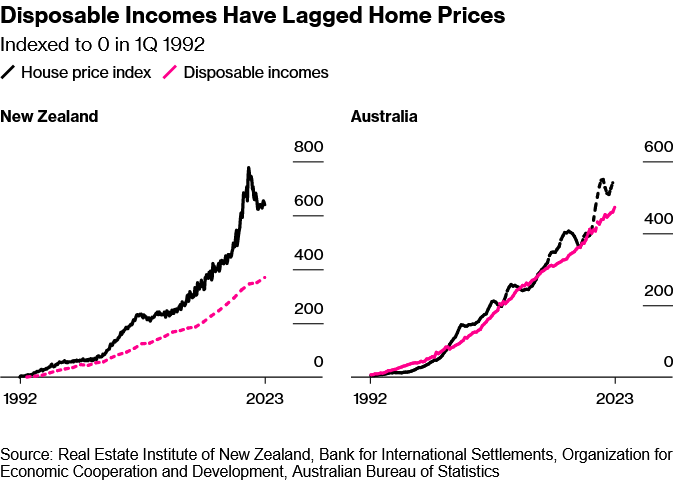

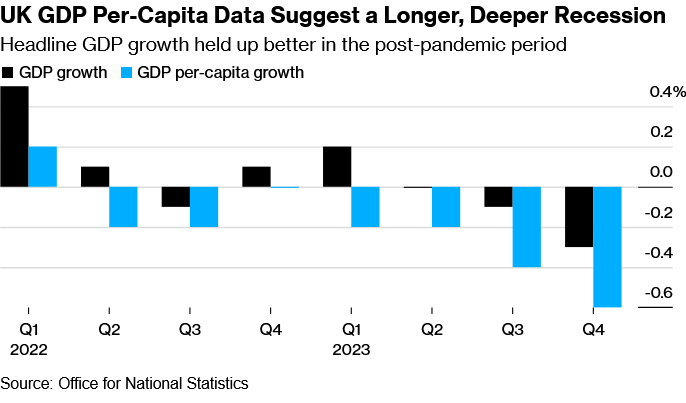

via Merryn Somerset Webb X feed a few more basement theses go mainstream-see underlined-incredible that noone in gubbermint thought to use GDP per capita rather than the nominal number.......we've only been discussing it tsince the thread started may be hard to belive but Ive cut a fari chunk out.worth a full read imho https://archive.ph/rmNaD#selection-1387.0-1393.99 Global Housing Shortages Are Crushing Immigration-Fueled Growth Households go backwards in 13 developed economies as record immigration runs into a housing crisis. Across much of the developed world, one of the most dependable drivers of economic growth is faltering. For decades, the rapid inflow of migrants helped countries including Canada, Australia and the UK stave off the demographic drag from aging populations and falling birth rates. That’s now breaking down as a surge of arrivals since borders reopened after the pandemic runs headlong into a chronic shortage of homes to accommodate them. Canada and Australia have escaped recession since their Covid contractions, but their people haven’t with deep per-capita downturns eroding standards of living. The UK’s recession last year looked mild on raw numbers but was deeper and longer when measured on a per-person basis. All up, thirteen economies across the developed world were in per-capita recessions at the end of last year, according to exclusive analysis by Bloomberg Economics. While there are other factors — such as the shift to less-productive service jobs and the fact that new arrivals typically earn less — housing shortages and associated cost-of-living strains are a common thread. In Australia, for instance, the inflow of roughly one million people, or 3.7% of the population, since June 2022 helped plug a chronic shortages of workers in industries such as hospitality, aged care and agriculture. And in the UK — an economy near full employment — arrivals from Ukraine, Hong Kong and elsewhere have made up for a lack of workers after Brexit. While the US has seen a widely-covered surge in authorized and irregular migration, the scale of the increase actually pales in comparison to Canada’s growth rate. For every 1,000 residents, the northern nation brought in 32 people last year, compared with fewer than 10 in the US. Put another way: Over the past two years, 2.4 million people arrived in Canada, more than New Mexico’s population, yet Canada barely added enough housing for the residents of Albuquerque. Canada’s experience shows there’s a limit to immigration-fueled growth: Once new arrivals exceed a country’s capacity to absorb them, standards of living decline even if top-line numbers are inflated. The Bank of Nova Scotia estimates a productivity-neutral rate of population growth is less than a third of what Canada saw last year, which would be more in line with the US pace. Canada’s working-age population grew by a million over the past year but the labor market only created 324,000 jobs. The upshot: The unemployment rate rose by more than a full percentage point, with young people and newcomers again the worst hit. The chronic underbuilding of homes and decades of continuous rises in prices has drained funds from other parts of the economy toward housing. That lack of investment in capital — combined with firms’ focusing instead on expanding workforces due to cheaper labor costs — has driven down productivity, which the Bank of Canada says is at “emergency” levels. But life won’t be easy Down Under either as many of the same strains are playing out, with Australia facing its worst housing crisis in living memory. Australia’s Housing Crisis: Lessons for the World Building permits for apartments and town houses are near a 12-year low and there remains a sizable backlog of construction work, largely due to a lack of skilled workers. The government has tried to plug the labor supply gap by boosting the number of migrants, only to find that’s making the problem even worse. Just like Canada’s experience, the ballooning population is not only exacerbating housing demand, it’s also masking the underlying weakness in the economy. GDP has expanded every quarter since a short Covid-induced recession in 2020, yet on a per-capita basis, GDP contracted for a third consecutive quarter in the final three months of 2023 — the deepest decline since the early 1990s economic slump. In absolute terms, Australia’s per-capita GDP is now at a two-year low — a “material under-performance” versus the US and an outcome that could spur higher unemployment, according to Goldman Sachs Group Inc. Over in Europe, its largest economy, Germany, also saw a per-capita recession that comes against a backdrop of rising political tensions over a large number of asylum seekers, housing shortages and a misfiring economy. Bloomberg Economics analysis shows that France, Austria and Sweden are also among those who have suffered per-capita recessions. In Britain, too, record levels of migration have begun to weigh on the economy. A technical recession in the second half of last year saw headline GDP slip 0.4%, yet the slump was longer and deeper when adjusted for population. Per-capita GDP has contracted 1.7% since the start of 2022, falling in six out of the seven quarters and stagnating in the other. With Britain close to full employment and over 850,000 dropping out of its workforce since the pandemic, immigration has helped employers fill widespread worker shortages, not least in the health and social care sectors. UK GDP has expanded 23% since the start of 2010. On a per-person basis, growth in output has been far less impressive at 12%. Over the same period, the population has surged, growing an estimated 11%, or almost 7 million, to 69 million. The Office for National Statistics expects it to hit close to 74 million in 2036 in updated population projections that now predict faster growth. Over 90% of the increase in the population expected between 2021 and 2036 will come from migrants, it said in January. -

Greedy Kite-Flying Probates thread

sancho panza replied to spunko's topic in Property Prices & Economy