All Activity

- Past hour

-

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

Again. It's the whole predicting the future thing. Which is very difficult. Which is why I mentioned there's no way of pound cost averaging into a house. House prices SHOULD have dropped from 2008 onwards, but they got propped up. I can't see any more props and I do see economic shit coming down the pipe. But do I want to bet a large amount of money on it? No. -

Credit deflation and the reflation cycle to come (part 9)

feed replied to spunko's topic in Property Prices & Economy

Depends if you think there will be a credit event or not. Without a substantial increase or decrease in available credit, average house price is just going to drift downwards for years, with almost of the action being inflationary. But averages hide a multitude of sins and on an individual level they're not that helpful. The UK market is really a bunch of small markets driven by proximity to places of employment and education. YMMV. -

Credit deflation and the reflation cycle to come (part 9)

Noallegiance replied to spunko's topic in Property Prices & Economy

Werner deals with this. It wasn't any one political leader. It was central banks instructing commercial banks to lend into property. -

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

"Demand" in this case is not "I want a house" though. Demand is "I want a house and credit is loose and cheap enough that I can get sufficient debt to pay for it". This is why part of me thinks house prices aren't going anywhere but perhaps down. He's worth whatever somebody is willing to pay him. What we think is irrelevant. -

The Big Short Time and Furnished Holiday Let thread ...

Wight Flight replied to spygirl's topic in Property Prices & Economy

Not quite. The costs are much higher. -

Credit deflation and the reflation cycle to come (part 9)

spygirl replied to spunko's topic in Property Prices & Economy

I'd treat that with a large trailer if salt. https://www.theguardian.com/politics/2023/may/19/rishi-sunak-akshata-murty-family-fortune-falls-by-200m-in-rich-list#:~:text=Sunak%2C a former hedge fund,from £730m in 2022. Rishi Sunak has seen his personal family fortune fall by more than £200m over the last year. Sunak, a former hedge fund manager and reputedly the UK’s wealthiest ever prime minister, and his heiress wife, Akshata Murty, have an estimated worth of about £529m in the latest Sunday Times rich list, a fall from £730m in 2022. Murty owns a small stake in Infosys, a $64bn (£52bn) Indian IT firm co-founded by her billionaire father. The value of that stake has fallen, driving the drop in the couple’s fortunes. The wealth is all wife's, and its equity in infosys. -

Credit deflation and the reflation cycle to come (part 9)

JMD replied to spunko's topic in Property Prices & Economy

I agree. An effective (i know!) government industrial policy would have achieved that. I note labour are dropping that policy phrase into many of their interview answers/statements etc. -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

Then couple the above with, they are seeing deflation as well ,in energy ,food and housing ! A lesson on how to grow your economy ,and you have people saying Chinas savings rates are a bad sign,did they ever ask how they managed to save so much -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Ah, another Sage moment! Pie And Slice Talk ©Harley 2020. -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

Yes, although the early, maybe even mid, boomers are well into the die off stage now. Suvivor bias very much in play. My MIL at 87 is the only one left in her family. Many friends went and still go much younger. Her friends are now typically much younger than her. -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

That`s not right house price are high because money was cheap for a very long time ,yes there is a supply issue but it has very little to do with prices Prices were pretty stable for a very very long time when it was only building societies and local councils that could issue mortgages outside of the commercial property market ,they only took off with Thatchers big bang which enabled Banks to offer mortgages for the residential sector -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

A very continental European thing. In Germany as an example. Most blocks owned by insurance, etc companies. -

Credit deflation and the reflation cycle to come (part 9)

Castlevania replied to spunko's topic in Property Prices & Economy

He’s not worth that much though is he. His wife is worth a lot and there is a huge conflict of interest in the government handing contracts to Infosys. Again, the government is too big, rubbish at spending money well and invariably hand money to large companies (such as Infosys) so the wealth trickles up to them. -

Credit deflation and the reflation cycle to come (part 9)

Harley replied to spunko's topic in Property Prices & Economy

The Norwegians do seem to have gone a bit weird lately. -

Credit deflation and the reflation cycle to come (part 9)

Long time lurking replied to spunko's topic in Property Prices & Economy

If you were buying would you like to pay more or less for what you are buying ? - Today

-

Credit deflation and the reflation cycle to come (part 9)

Yadda yadda yadda replied to spunko's topic in Property Prices & Economy

Globalisation is the impoverishment of "the West". We need foreign resources and we can't get them cheaply any longer and thus we are poorer. The rich have made sure they retain their slice by outsourcing to cheaper countries, importing cheaper workers, destroying unions in most sectors and devaluing cash. This means the average person has a shrinking share of a shrinking pie. We don't have capitalism since we bailed out banks. Pure capitalism isn't the answer anyway. We should have retained a larger steel industry through import tariffs or subsidies. Our Government is not run for the benefit of the British people. It is run for the benefit of billionaires most of whom are foreign. -

Credit deflation and the reflation cycle to come (part 9)

Yadda yadda yadda replied to spunko's topic in Property Prices & Economy

I first saw a link to Gary's videos on this thread. I quite like him but don't think he is telling the whole story. You can't talk about inflation without addressing the supply side of the equation. House prices are high because demand is much higher than supply. Yes a lot of that demand is from the rich both directly and from lending money. They still need people to rent to and an increasing population due to immigration feeds that. It is also a large reason why houses are split into flats. He is also weak on why inequality has been increasing. Yesterday he blamed low wages on increased inequality but is it not low wages that are causing greater inequality? Inflation is largely the fault of government policy. He does not address this at all. He doesn't mention how he is going to tax the rich either. They will simply leave. Unless you have a global government and that would mean massive corruption, the permanent eradication of meaningful democracy and the wealthy controlling everything. -

Credit deflation and the reflation cycle to come (part 9)

JoeDavola replied to spunko's topic in Property Prices & Economy

So what is the solution? Do we agree that Sunak earning £1 million a week for doing nothing on his estimates wealth of £700 million is pretty disgusting? Or is some sort of limit on wealth not 'capitalist'. I don't see how capitalism is seen as so faultless here, but perhaps there is a difference between what capitalism was 50 years ago and the globalist flavour of it. -

Credit deflation and the reflation cycle to come (part 9)

Mandalorian replied to spunko's topic in Property Prices & Economy

I sometimes think about moving to a better area but I wonder if I'd be overpaying. Last thing I want is to hand over my hard earned capital and then be able to get the same place cheaper 2 years later. I'd rather sit tight for 2 years. Is this the consensus now? I.e. There isn't going to be a HPC and it's just going to stagnate indefinitely? The rational side of me says just buy somewhere. The emotional side of me (second most expensive thing I will ever buy*) says wait. Annoying buying a house isn't like buying shares. You can't drip feed in and average up or down. * Most expensive is the price you pay for the State and all the hangers on. -

Credit deflation and the reflation cycle to come (part 9)

feed replied to spunko's topic in Property Prices & Economy

Small time BTL is done, no doubt. And high taxation and high inflation to erode the middle class. Both savings and assets. Financial repression as direction of travel, but financial repression is stealing from old people slowly. Slowly can take decades. i think it'll take some generational die off and the house inheritance not bringing in any real wealth for people to start to pay attention. -

Credit deflation and the reflation cycle to come (part 9)

Chewing Grass replied to spunko's topic in Property Prices & Economy

Will tie in with pension companies having less to invest in, always said both here and on the other side that they will keep the balls in the air until they have stolen most peoples retirement (pension). Bottom of the barrel scraping time. -

Credit deflation and the reflation cycle to come (part 9)

DurhamBorn replied to spunko's topic in Property Prices & Economy

https://www.telegraph.co.uk/business/2024/05/05/britain-better-off-fewer-buy-to-let-landlords/ We said on here years ago the big insurance companies etc would end up controlling the rental sector and its starting to gain traction.Government will keep tightening rules so that only big landlords can cope and the smaller throw in the towel.It will take a long time,but middle class BTL is now on a long decline.BTL has protected capital from welfare induced inflation because of housing bennies and the government cannot be having that.These big institutions already have the capital so will likely have very low LTV on their estates.Its a bit like all the companies being bought out,slowly income producing assets are being removed from ordinary people. -

Credit deflation and the reflation cycle to come (part 9)

Virgil Caine replied to spunko's topic in Property Prices & Economy

It was simple to understand. There were those who fought, those who prayed and those who worked. It needs to be remembered though that the system only really developed once the Roman Empire collapsed and that it was a reversion to a threefold division of warriors, holy men and farmers that existed in many ancient tribal societies. -

Credit deflation and the reflation cycle to come (part 9)

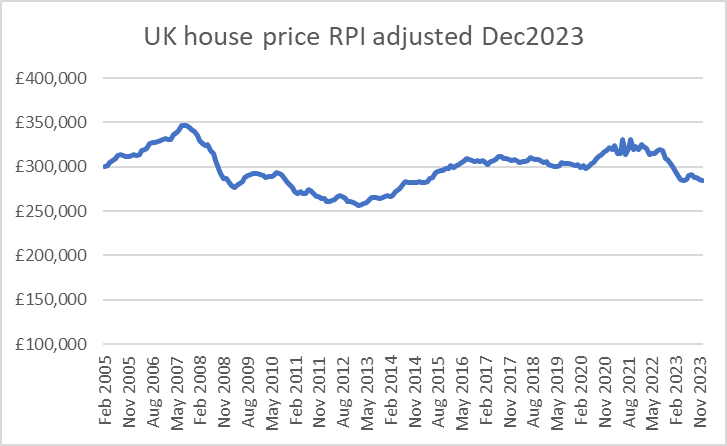

feed replied to spunko's topic in Property Prices & Economy

UK house prices have done nothing but slowly ground down since covid. I lost my longer term data, but quick look at recent figures and 10 years of nowhere, RPI adjusted. Without a credit event, they're not going to do much else. 2007 will be our real term peak, for a very long time. -

Credit deflation and the reflation cycle to come (part 9)

Axeman123 replied to spunko's topic in Property Prices & Economy

Maybe rather than just spending from the fund they are reducing contributions from taxation to it and redirecting that money to spending? If they spend it on imports (high speed trains or MRI machines say, assuming they don't make them there) then that would even push the currency down further AIUI. The whole sovereign wealth fund seems like a nice idea, but when the rubber meets the road I expect it to get spent down for short term gain. I suspect (using my example of big ticket capital expenditure imports) it also introduces its own perverse incentives for government too.